9 Easy Facts About Offshore Company Formation Shown

Table of ContentsThe Definitive Guide for Offshore Company FormationOffshore Company Formation - The FactsOffshore Company Formation Things To Know Before You BuyEverything about Offshore Company Formation4 Easy Facts About Offshore Company Formation DescribedOffshore Company Formation Can Be Fun For Everyone

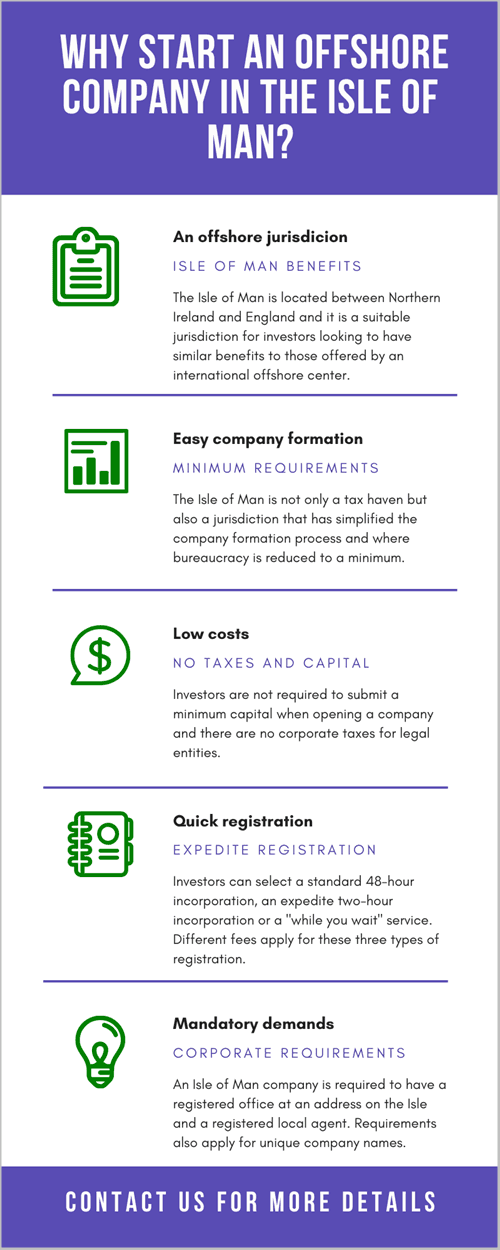

Although tax obligation performance is the major advantage, proprietors may likewise benefit from reduced company expenses. There are typically less lawful obligations of administrators of an overseas firm. You can additionally make a decision to have online office services that are both affordable and they also assist in saving time. It is likewise usually easy to establish an overseas business and also the procedure is less complex compared to having an onshore business in many components of the globe.In fact, there are various other territories that do not call for capital when signing up the company. An overseas company can function well for several groups of individuals. If you are a businessman, as an example, you can create an overseas firm for privacy purposes as well as for convenience of administration. An overseas company can likewise be made use of to accomplish a consultancy service.

The smart Trick of Offshore Company Formation That Nobody is Discussing

The procedure can take as little as 15 mins. Even prior to developing an offshore company, it is initially crucial to know why you favor overseas company development to setting up an onshore company. Do not established up an offshore firm for the incorrect factors like tax evasion and cash laundering.

If your major goal for opening up an offshore company is for privacy objectives, you can conceal your names making use of candidate services. There are a number of things that you need to birth in mind when choosing an offshore jurisdiction.

All about Offshore Company Formation

There are rather a number of offshore jurisdictions and also the entire task of coming up with the best one can be fairly made complex. There are a number of points that you also have to put right into consideration when choosing an overseas territory.

If you established an overseas business in Hong Kong, you can trade globally without paying any neighborhood taxes; the only condition is that you need Check This Out to not have you can try this out an income source from Hong Kong. There are no taxes on funding gains as well as investment income. The area is likewise politically and also economically stable. offshore company formation.

With a lot of territories to select from, you can constantly discover the most effective place to develop your overseas company. It is, however, essential to take notice of information when creating your selection as not all business will permit you to open up for checking account as well as you need to guarantee you exercise appropriate tax obligation planning for your regional as well as the international territory.

The Only Guide to Offshore Company Formation

Business structuring and also preparation have actually attained higher degrees of intricacy than in the past while the need for privacy remains strong. Corporations must maintain rate as well as be regularly on the lookout for new means to benefit. One means is to have a clear understanding of the characteristics of offshore international companies, and also how they may be propounded advantageous usage.

A more correct term to use would be tax obligation reduction or preparation, due to the fact that there are means of mitigating tax obligations without damaging the regulation, whereas tax obligation evasion is usually classified as a criminal activity. Yes, because most countries urge global trade and also venture, so there are normally no limitations on locals doing company or having savings account in various other nations.

The 8-Minute Rule for Offshore Company Formation

Sophisticated and also trusted high-net-worth individuals as well as companies regularly use overseas financial investment lorries worldwide. Securing possessions in combination with a Trust, an overseas company can avoid high levels of revenue, resources and also fatality taxes that would certainly or else be payable if the assets were held directly. It can additionally safeguard properties from creditors as well as various other interested parties.

If the business shares are held by a Trust fund, the ownership is lawfully vested in the trustee, hence acquiring the possibility for also greater tax preparation benefits. Family as well as Safety Trust funds (possibly as an option to a Will) for buildup of financial investment income as well as lasting benefits for recipients on a favorable tax basis (without revenue, inheritance or capital gains taxes); The sale or probate of buildings in different countries can come to be complicated and also expensive.

Conduct business without company taxes. Tax havens, such as British Virgin Islands, allow the development of International Companies that have no tax obligation or reporting obligations.

The 15-Second Trick For Offshore Company Formation

This permits the charges to gather in a reduced tax territory. International Companies have the same civil liberties as a private person and also can make financial investments, deal realty, profession i loved this profiles of stocks and bonds, as well as conduct any lawful service activities so long as these are not done in the country of enrollment.